Navigating the Complexities of Pay-roll Compliance: How Professional Services Ensure Regulatory Adherence

In the realm of service procedures, adhering to pay-roll conformity guidelines stands as an essential facet that requires meticulous focus and competence. Making certain that a company fulfills the complex web of lawful requirements controling payroll can be a daunting job, particularly with the ever-evolving landscape of tax laws and labor regulations - Best payroll services in Singapore. Specialist solutions specializing in pay-roll conformity provide a beacon of guidance via this maze of complexities, supplying a shield versus possible violations and fines. By turning over the intricacies of pay-roll conformity to these experts, businesses can navigate the regulatory terrain with self-confidence and precision, securing their procedures and making sure economic honesty.

Value of Governing Conformity

Making certain governing conformity is vital for specialist solutions organizations to preserve functional honesty and reduce legal threats. Sticking to laws established forth by regulating bodies is not just a box-ticking workout; it is an essential facet of maintaining the trustworthiness and trust that clients position in these companies. Failing to adhere to regulatory needs can result in extreme repercussions, including economic penalties, reputational damages, and also lawsuit. Expert services organizations operate in an intricate landscape where laws and policies are frequently developing, making it imperative for them to stay abreast of any adjustments and ensure their practices continue to be certified.

Know-how in Tax Laws

Effectiveness in browsing intricate tax obligation guidelines is indispensable for expert solutions companies to maintain financial conformity and support honest standards. Expert services companies should have a deep understanding of tax codes, deductions, credit reports, and conformity requirements to make sure accurate monetary reporting and tax obligation declaring.

Monitoring Labor Laws Updates

Staying notified regarding the most current updates in labor legislations is essential for specialist services companies to make certain compliance and reduce dangers. As labor laws are subject to constant changes at the government, state, and neighborhood levels, following these advancements is vital to avoid lawful issues or potential penalties - Best payroll services in Singapore. Specialist solutions companies have to establish robust mechanisms to keep an eye on labor regulations updates properly

One way for organizations to remain educated is by subscribing to newsletters or notifies from appropriate government companies, market associations, or lawful specialists concentrating on labor legislation. These sources can offer prompt notifications concerning brand-new regulations, changes, or court rulings that may influence pay-roll conformity.

Additionally, professional services firms can take advantage of payroll software remedies that provide automatic updates to ensure that their systems are aligned with the newest labor legislations. Regular training sessions for human resources and payroll staff on recent legal changes can likewise enhance understanding and understanding within the company.

Decreasing Compliance Risks

Moreover, staying informed regarding regulative adjustments is essential for reducing conformity dangers. Professional services firms should constantly keep track of updates to labor laws, tax policies, and coverage needs. This aggressive strategy guarantees that payroll procedures continue to be compliant with the current lawful standards.

Additionally, investing in worker training on conformity issues can improve recognition and lower errors. By educating employee on relevant legislations, guidelines, and finest practices, organizations can cultivate a society of conformity and minimize the chance of violations.

Advantages of Specialist Pay-roll Services

Navigating payroll compliance for expert services organizations can be dramatically structured via the utilization of professional payroll services, offering a range of her explanation advantages that enhance performance and accuracy in taking care of payroll procedures. Expert payroll service companies are well-versed in the intricacies of payroll laws and can make sure compliance with ever-changing legislations and tax demands.

One more benefit is the automation and assimilation abilities that professional pay-roll services offer. By automating routine tasks such as computing reductions, incomes, and tax obligations, companies can enhance their pay-roll procedures and reduce the capacity for blunders. Integration with other systems, such as accounting software, additional improves efficiency by eliminating the need for hand-operated information access and settlements.

In addition, expert payroll services offer safe information management and discretion. They use durable protection measures to secure delicate worker information, lowering the risk of information violations and making certain compliance with information protection regulations. Overall, the benefits of expert payroll services contribute to cost savings, accuracy, and assurance for expert services organizations.

Conclusion

Finally, professional payroll services play an essential function in guaranteeing regulatory adherence and minimizing conformity threats for businesses. With their competence in tax policies and continuous surveillance of labor laws updates, they supply beneficial assistance in browsing the intricacies of pay-roll conformity. By handing over pay-roll obligations to professional services, services can focus on their core procedures while maintaining lawful compliance in their payroll processes.

To minimize conformity risks successfully in specialist solutions companies, comprehensive audits of pay-roll procedures and paperwork are critical.Navigating payroll conformity for professional services companies can be considerably structured via the application of professional pay-roll solutions, using you could try these out an array of advantages that enhance efficiency and accuracy in taking care of payroll procedures. Expert pay-roll service companies are fluent in the intricacies of payroll regulations and can guarantee compliance with ever-changing regulations and tax demands. Generally, the advantages of expert payroll services add to cost financial savings, accuracy, and peace of mind for professional solutions organizations.

By leaving pay-roll obligations to useful source expert solutions, companies can concentrate on their core procedures while keeping legal conformity in their payroll procedures.

Edward Furlong Then & Now!

Edward Furlong Then & Now! Romeo Miller Then & Now!

Romeo Miller Then & Now! Charlie Korsmo Then & Now!

Charlie Korsmo Then & Now! Hailie Jade Scott Mathers Then & Now!

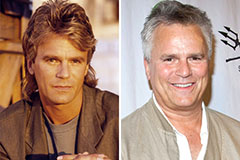

Hailie Jade Scott Mathers Then & Now! Richard Dean Anderson Then & Now!

Richard Dean Anderson Then & Now!